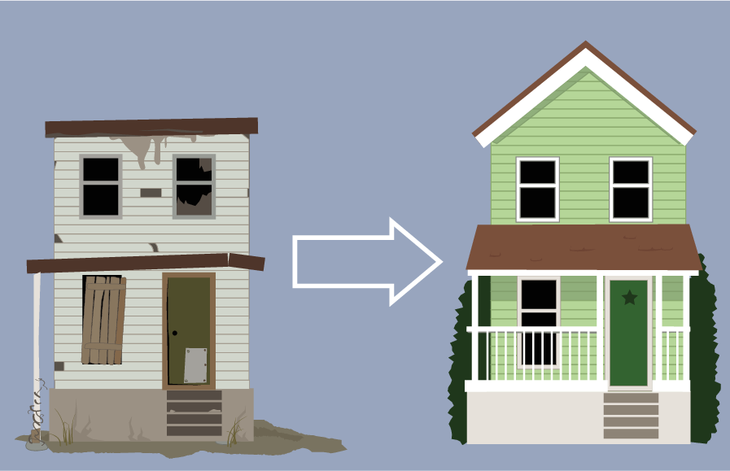

Flipping houses for big returns

Flipping houses can earn big returns if you’re ready to put in the work. Additionally, there is certainly good money to be made. Just be smart, as emotion-free as possible and get ready for a real estate ride like no other. And no, it’s not as easy as it looks on TV.

1. Do the math

Figure out what you can spend on both the house and the renovation down to the last dollar. Include how much risk you are prepared to take. Price out the cost of carrying a short-term loan (if you need one), taxes, utilities and maintenance on the home for up to a year. Price out your material costs and labor. Look at comparable sales in the market to see what the likely sale price will be. Once you have a financial plan in front of you, with a reasonable margin for risk, begin shopping for homes that meet that budget. Don’t let a huge fixer-upper with potentially larger returns muddle your math.

2. Know your market

Question if property is already in an established area with rising prices? Is it a transitional neighborhood with good potential that may not be quite “there” yet? Or, is this an area with good schools that will attract families? Is this a community popular with retirees? Knowing your market will help you to choose the most desirable home and it should help you know what your profit margin will be. Every neighborhood has a not-to-exceed price. Know what that is. Doing your homework on recent sales and average days on market can give you an idea of how long to hold the property before flipping. Perhaps you want to rent it for a year or two until the neighborhood really takes off, or do a quick renovation because the neighborhood is very competitive.

Leave A Comment