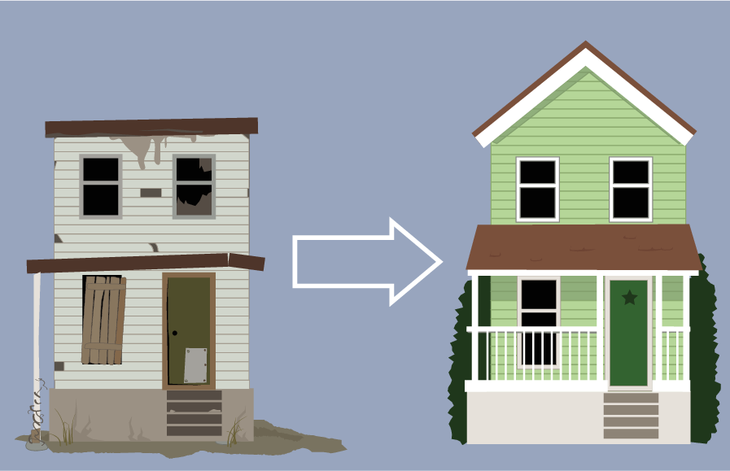

Hard Money Investment Loans For Rehab Project

Real estate financing, by way of hard money loans are essentially a non-bankable loan on an investment single family home or duplex. Hard money loans are frequently interchanged with no-doc loans, private loans, bridge loans, etc… For a residential hard money loans, the underwriting decisions are primarily based on the borrower’s hard assets. In this case, the residential investment real estate would be used as collateral for the transaction. Residential hard money loans close quickly. This type of loan is a good option for those looking to rapidly fund, rehab, and flip for profit.

Chicago Rehab Loans is the recognized residential hard money lender and is significantly different that traditional banking. We have the flexibility to provide loans that make sense and meet the individual needs for each and every borrower. Hard money loans provide the borrower with the flexibility they need to maximize their opportunity and profitability when considering purchase and renovations on a residential or commercial property.

When is a Residential Hard Money loans appropriate?

- Borrowers with impaired credit (Chicago Rehab Loans can lend to borrowers with any credit including past bankruptcies)

- Tax Liens/Judgements/unpaid items etc..

- Borrowers that need funds quickly on their residential investment property (typical funding time is approximately 7 to 14 days for hard money loans)

- Property repositioning

- Time constrained borrowers/ Borrowers need a quick closing

- Borrowers in need of a stated loan due to tax returns (or lack thereof)

- Foreclosure avoidance

- Foreign Nationals

- Borrowers do not have the time or energy to jump through the multiple hoops of a conventional lender

- Complex loans with multiple pieces of collateral

- Chicago Rehab Loans is able to handle many unique residential real estate financing needs with no upfront fees on investment single family homes.

Leave A Comment