Indiana legislators made changes to get blighted properties out of local government tax sales — but not in time to affect Friday’s annual sale of liens for tax-delinquent properties in Evansville.

Marco DeLucio, an attorney who advises city government on blight-related issues, said Senate Enrolled Act 415, signed into law by Gov. Mike Pence in May, left local code enforcers without enough time to identify properties that could qualify for exemption from the tax sale and carry out all the required hearings. The process is time-consuming, DeLucio said, because all mortgage holders, lien holders and others with interests in properties must be notified for hearings that could be contested.

The tax sale’s date is chosen by the Vanderburgh County Treasurer’s Office, which conducts the sale, and Synergistic Resources Integration, the Indianapolis-based company that takes bids. The county will not pay SRI, which receives instead a percentage of each winning bid.

Treasurer Susan Kirk said she and SRI could have moved the date back, but waiting was prudent.

“Now, by the time next year rolls around, we need to be ready to go.”

Friday’s tax sale, in Room 301 of the Civic Center, is expected to offer 525 houses, lots and structures — rental, commercial, owner-occupied — whose owners failed to pay three consecutive seasonal installments of Vanderburgh County property taxes.

Kirk said her office will watch to see whether profit-minded investors turn out in smaller numbers. She cited reductions in the maximum per-annum interest rate that property owners must pay high bidders if the owners redeem their formerly tax-delinquent properties.

“It’s kind of a test year,” she said. “We’ll probably give it one more year after this doing it the way we do it now — and then, if our bidders go down enough, we’ll consider trying (conducting the tax sale) online to see if we don’t get some more bidders.”

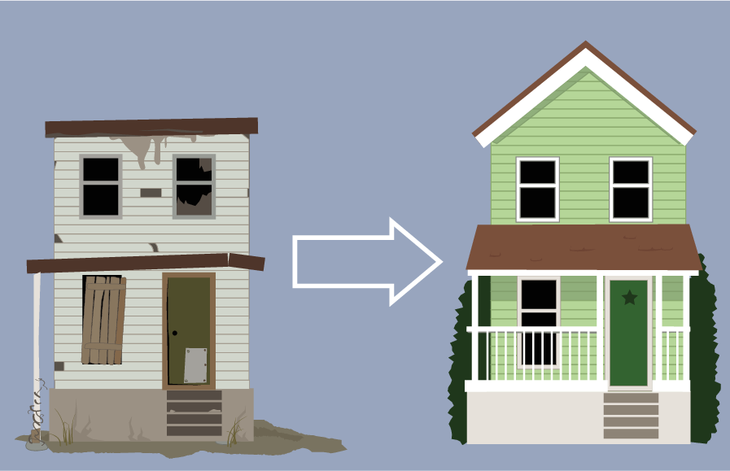

The changes in state law that will take effect at next year’s tax sale were intended by legislators to remove from the process the blighted properties that are unlikely to be sold at tax sale anyway.

This is an important change for tax buyers in Indiana and to read the rest of this relevant article written by THOMAS B. LANGHORNE click here.

Leave A Comment