What Are Investment Loans?

By Kimberly Hoffman

Investment loans provide a way to enjoy the potential for market appreciation while building equity each month. In addition, the monthly cash flow from a real estate investment can provide extra income, help pay down debt faster, and begin living life on your own terms.

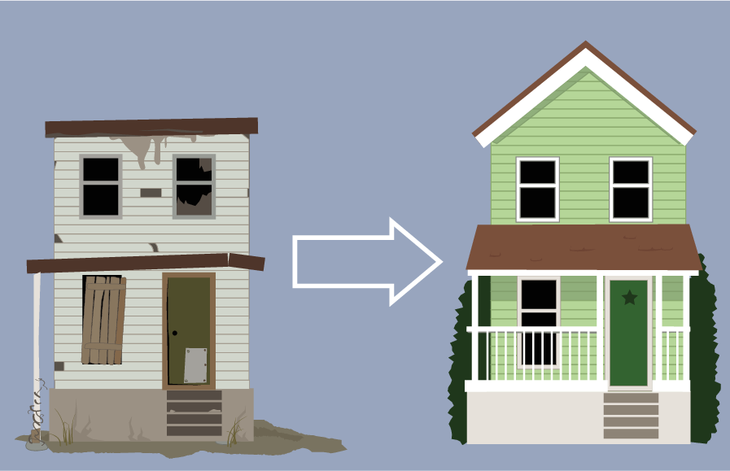

However, unless you have cash in hand for your investment property, you will need to secure a investment loan. Investment loans can be used to purchase an property or refinance an existing investment. Whether you are purchasing or refinancing a single or multi-family home or commercial property – getting the best loan is essential to your bottom line. Investment loans can also be used for real estate development, such as new construction, spec building, or raw land development.

Loan terms and rates will directly affect your monthly cash flow. You must first understand the differences between investment loans and a typical home mortgage.

Because lending institutions will traditionally have two completely different departments to deal with home loans vs. commercial loans, qualifying standards may differ. It is important to do your research and compare options before committing to specific investment loan.

While most traditional lenders demand burdensome financial information and reserve requirements to make any loans, hard money lenders funding process can be a quick and simple one-step application process. There are usually minimum credit score requirements, document requirements, and minimum income checks required. Qualified commercial properties include:

To find potential investment loan opportunities click here.

Leave A Comment